Approved for Level 2 options. Why can’t I sell a cashsecured put and a call spread at the same time?

Summary of User Concern and Solutions:

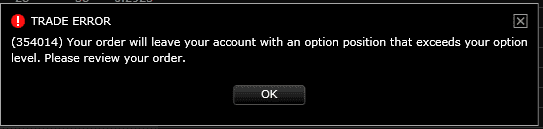

- The main problem reported by the user is the inability to execute a combined order for selling a cash secured put and a call spread, receiving an error message that the order exceeds their option level, despite being approved for both strategies.

- A suggested solution is to change the trade type from “margin” to “cash” when placing the cash secured put order, which may resolve the error encountered.

- The user is encouraged to contact customer support for a review of their specific account in a secure environment, either through direct messaging on social media or via the provided contact link.

Here’s the full thread