Can someone help me read my report?

Here’s a summary of the main problem and the solutions discussed:

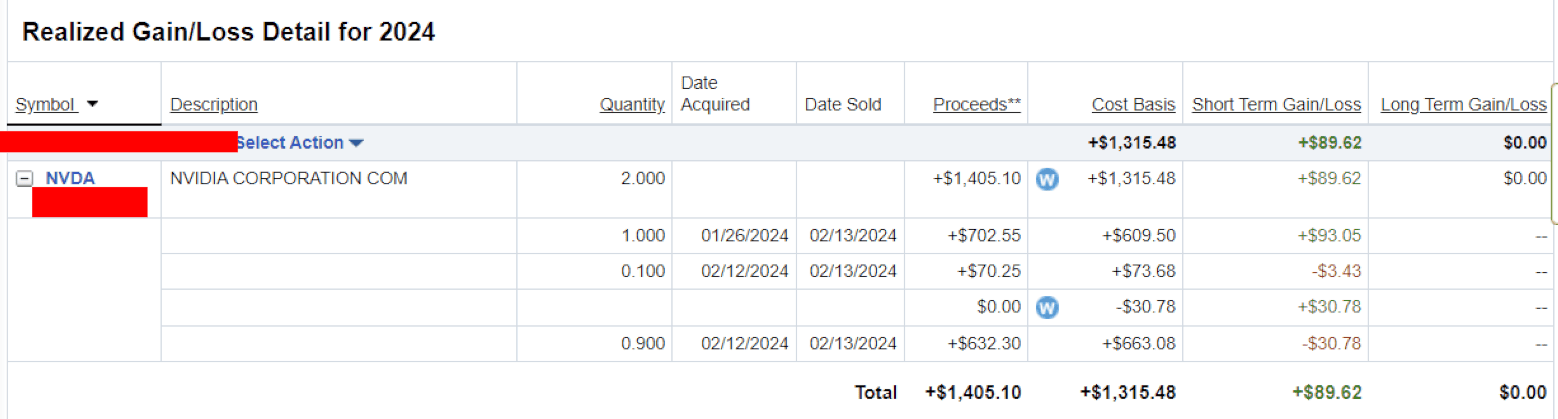

- Main Problem: The user is confused about why their trades for NVIDIA shares appear as separate line items and if Fidelity sold their shares in a specific order.

- Solution: Fidelity explained that the default method for disposing of stocks is “First in, First out” (FIFO), meaning the shares held the longest are sold first, which accounts for the separate line items.

- Additional Solution: The user can change their default disposal method by logging into their Fidelity account and following specific steps, but this change will take effect overnight and won’t affect cost basis information for trades already settled.

- Further Assistance: Fidelity offered to review the user’s trades further and provided contact information for additional support.

Here’s the full thread