Confused about selling stocks within a Roth IRA

Here’s a summary of the main problem and solutions discussed in the conversation:

- Main Problem: The user wants to sell shares of FSKAX in their Roth IRA to invest in FXAIX but is unsure how to do this without incurring taxes or losing money.

- Solution 1: It was confirmed that selling shares within a Roth IRA does not incur taxes, as these accounts are tax-advantaged.

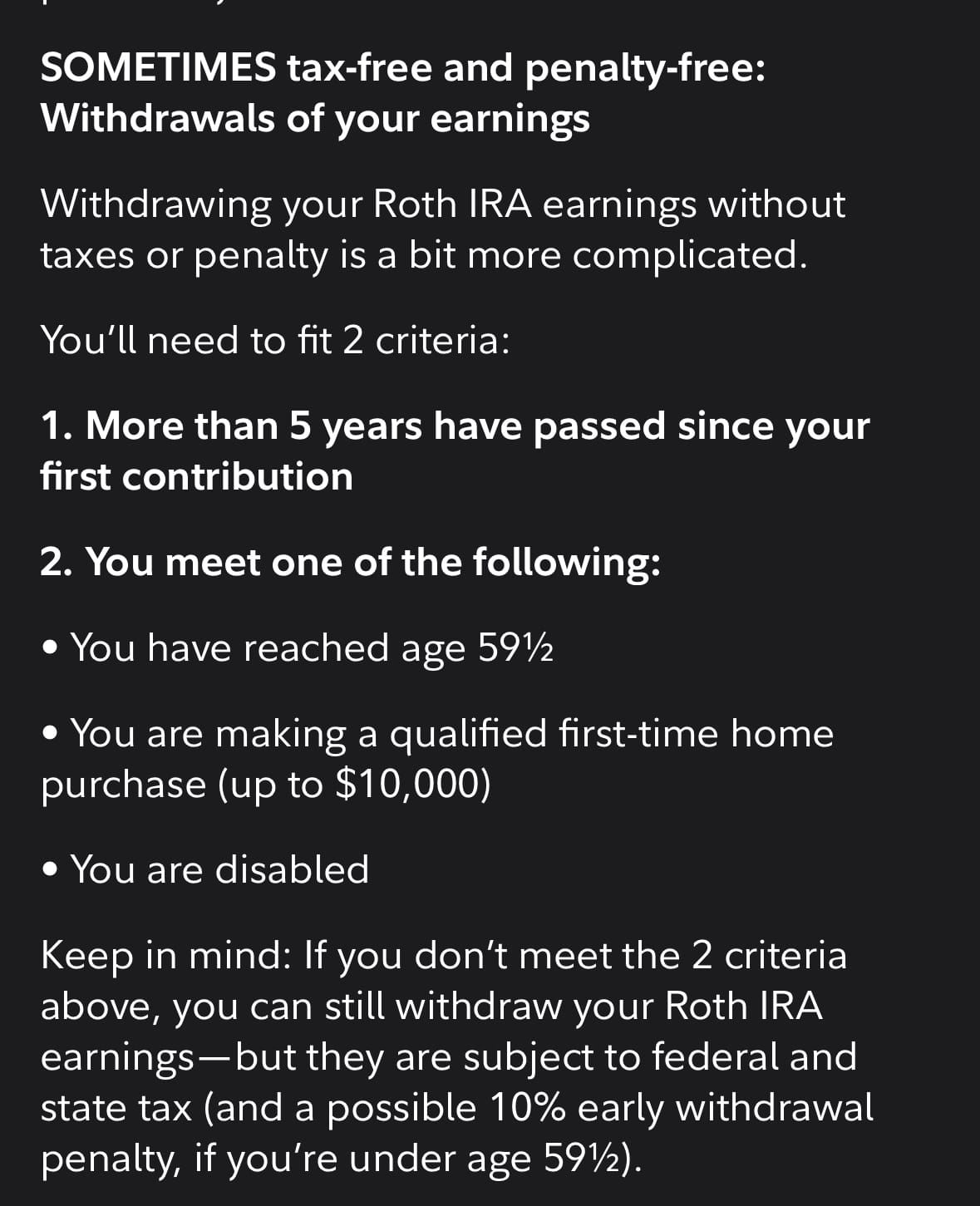

- Solution 2: The user can trade freely in the IRA, and they would only need to consider taxes or penalties if they decided to withdraw funds from the account.

- Additional Resource: A link was provided for more information on IRA withdrawals to help clarify any further questions.

Here’s the full thread