Thanks for reaching out,

@Theyluv_Aldo. Apologies for the delay in our response. I’m happy to provide some information on the deposit process.

Deposits made to Fidelity accounts are automatically placed in your

core position, which comes with every brokerage account and is chosen upon account opening. The core is where all un-invested cash sits while it awaits withdrawal or investment and is often referred to as the wallet of the account. You can learn more about the core via the link below.

What is a core position? (PDF):

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/mutual-funds/what-is-a-core-position.pdf

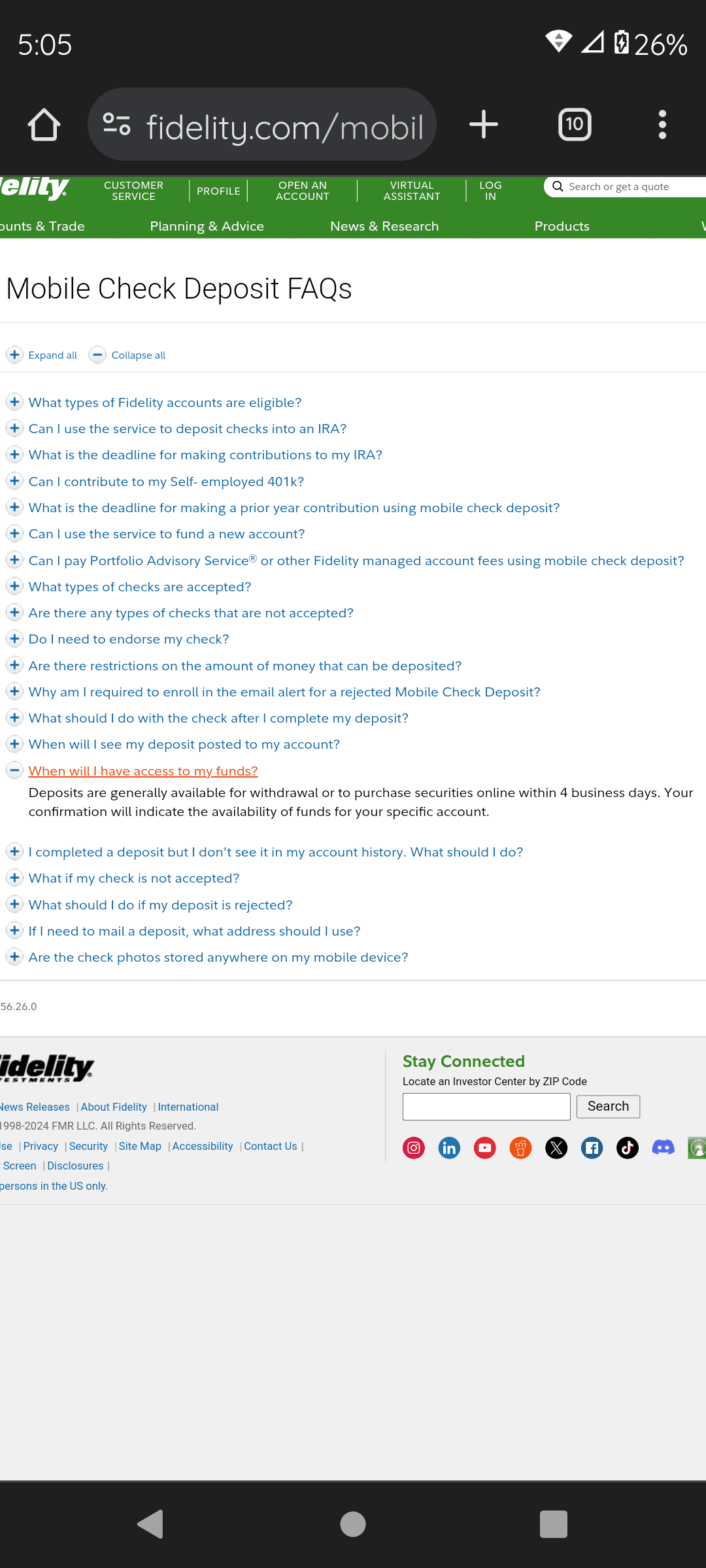

Upon deposit, the funds become visible in their applicable balance based on your chosen deposit method. For checks, which typically take 2-6 business days to be fully collected and available to withdraw, the funds will be visible in your “Available to trade” balance. However, once the deposit is fully collected, those same funds, if they remain unused, will move over to your “Available to withdraw” balance.

It’s worth mentioning that Fidelity does allow clients to purchase securities using uncollected deposits – subject to security type and daily limit restrictions. However, it’s important to be mindful of potential cash trading violations, such as a Good Faith Violation (GFV), which will occur if you sell securities purchased with uncollected funds before the post date of the deposit. You can learn more below.

Avoiding cash account trading violations:

https://www.fidelity.com/learning-center/trading-investing/trading/avoiding-cash-trading-violations

Please let us know if more questions come up or if we can clarify anything further. We’re happy to help however we can! 🟢