How do I know which one??

Here’s a summary of the main problem and solutions discussed in the conversation:

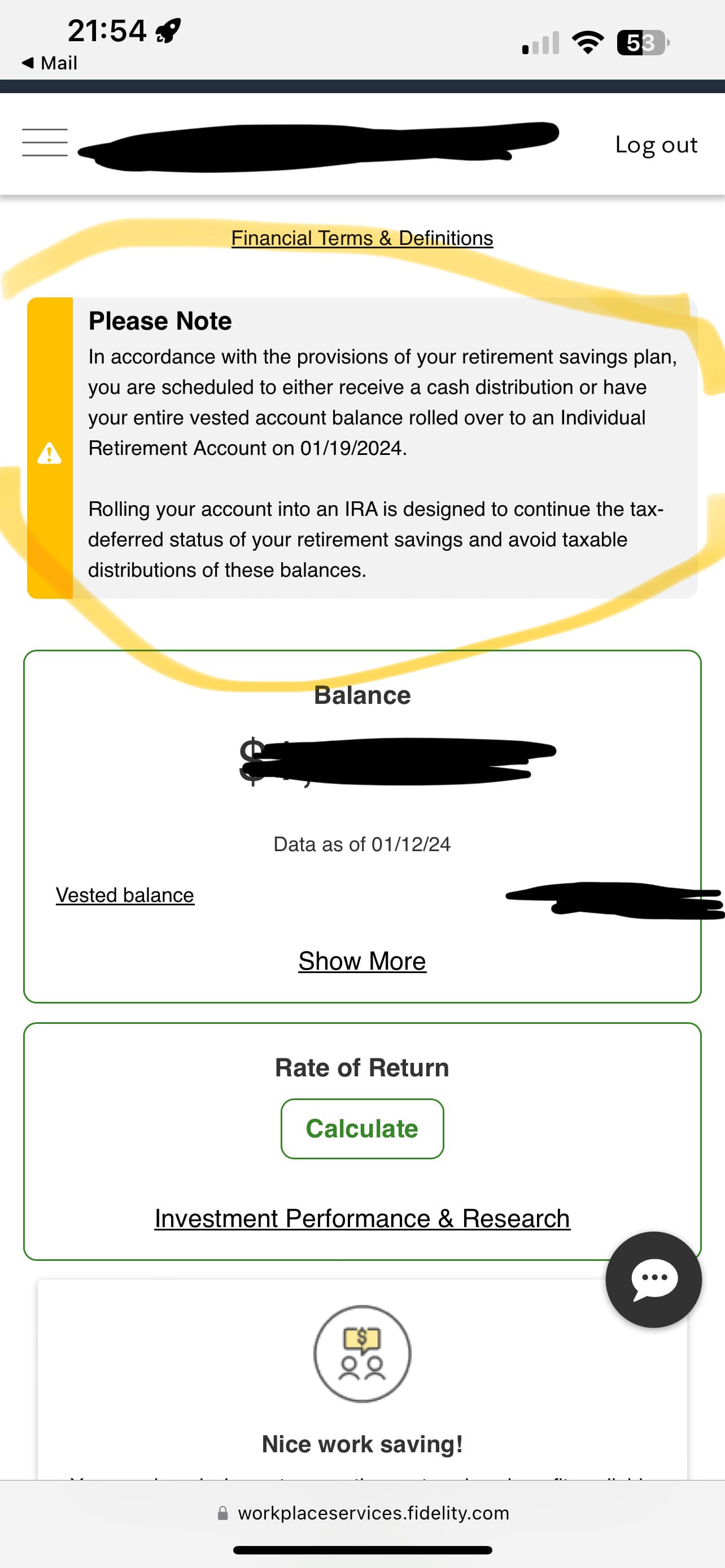

- Main Problem: The user, Marie, is unsure about the options available for her retirement funds after leaving a job, specifically whether she will receive a cash distribution or if the funds will be rolled over into a new retirement account.

- Solution: Fidelity suggests that she contact their Workplace Investing team to discuss her options further. They are available on regular business days from 8:30 a.m. to midnight ET.

- Additional Resource: Fidelity provides a link to an article that explains what happens to a 401(k) when someone quits a job, which could help clarify her situation.

Here’s the full thread