IRA contributions are not updating

Here’s a summary of the user’s reported problem and the solutions discussed:

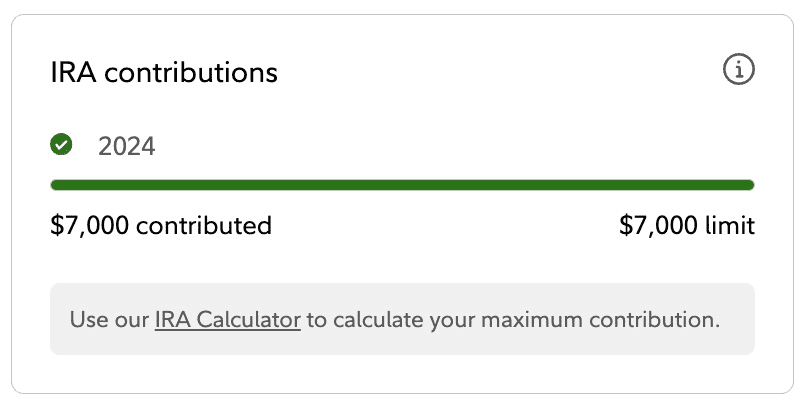

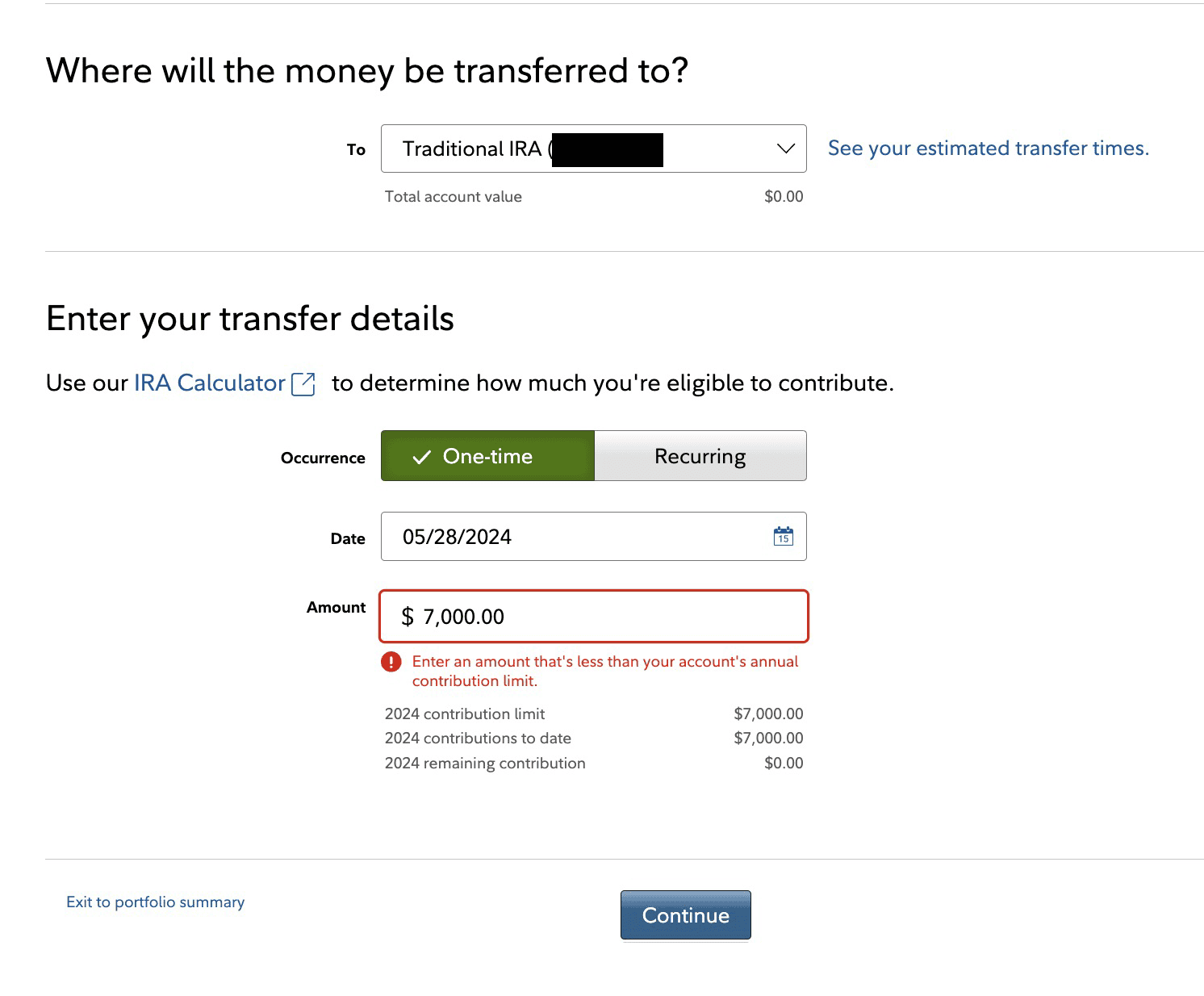

- Main Problem: The user maxed out their Roth IRA for 2024 while ineligible and requested a Return of Excess, but their Traditional IRA contribution tracker still shows the 2024 contributions maxed out.

- Solution 1: The contribution tracker will not update after a Return of Excess request, and the original contribution must still be reported for tax purposes.

- Solution 2: The user can still make future contributions to their Traditional IRA, but they should track their contributions manually to avoid exceeding the limit.

- Solution 3: If the user encounters issues making contributions online due to the tracker showing maxed contributions, they should contact Fidelity’s support team for assistance.

Here’s the full thread