Hey there,

@r1khil. Thanks for stopping by this morning! I’ll be happy to shed some light on this for you.

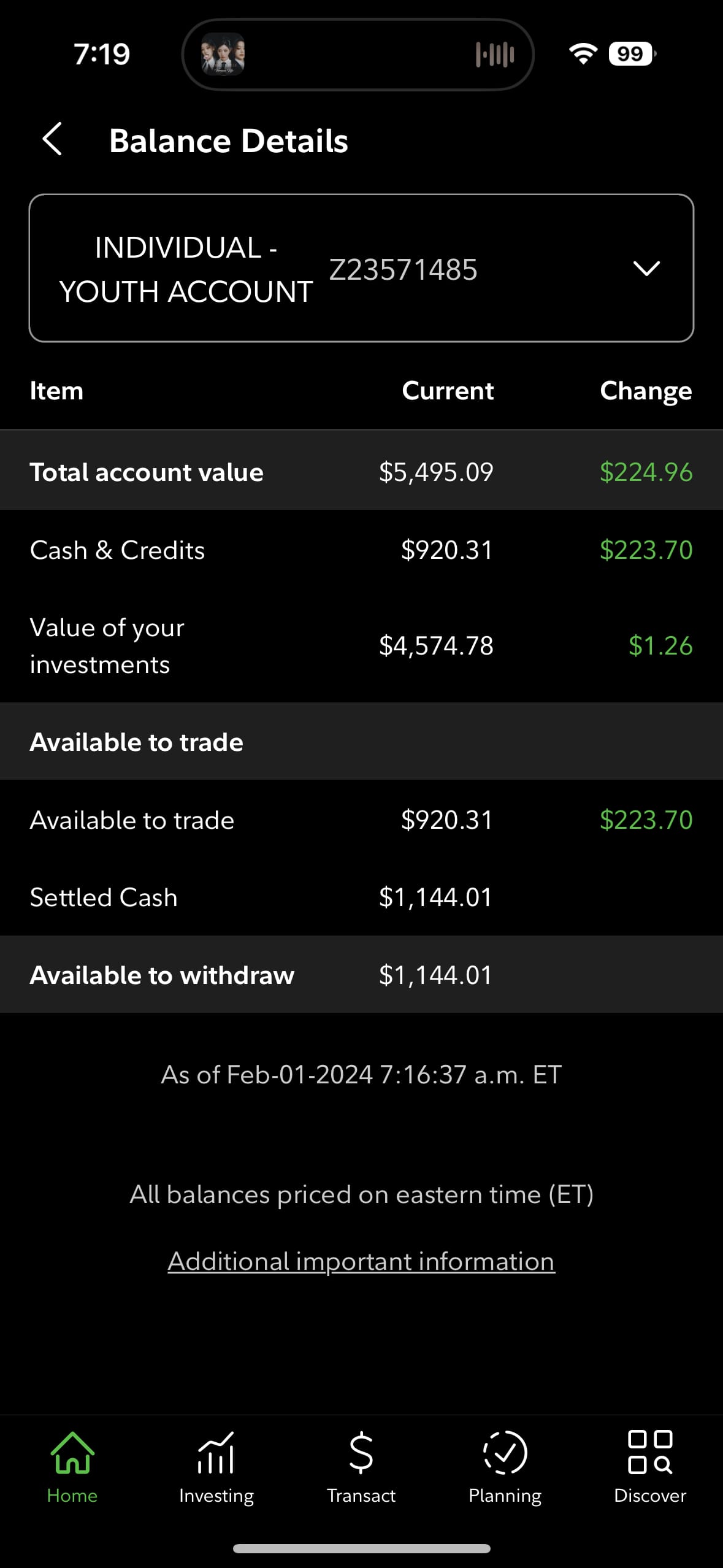

In short, this is not necessarily the intended behavior for direct deposits. However, this can likely be explained fairly easily. It sounds like your account may have funds committed to open orders. This would explain why your “Cash Available to Trade” balance is less than Settled Cash, indicating open orders that haven’t been executed yet.

The good news is that you can see if your cash has indeed been committed to open orders by logging into Fidelity.com. Once logged in, simply select your account, click the “Balances” tab, and look for “Cash Committed to Open Orders”.

Cash Available to Trade represents the amount available to purchase securities in a cash account without adding money to the account. Executed buy orders will reduce this value (at the time the order is placed), and executed sell orders will increase this value (at the time the order executes).

Settled cash is simply the portion of your cash (Core) balance that represents the number of securities you can buy and sell in a cash account without creating a

Good Faith Violation. Since direct deposits are considered to be collected upon receipt, this isn’t something you need to worry about at this time.

For a deeper dive into account balances and what they mean, I’ll link a great article below. Feel free to check it out.

Understanding Your Account Balances:

https://www.fidelity.com/learning-center/tools-demos/trading-tools/nextgen-balances-video

For your second question, this is not necessarily something we can answer, as the early deposit could be associated with your employer utilizing an early paycheck feature. We cannot confirm this is the case though, so I suggest reaching out to your employer for more insight.

All that being said, we’re glad you stopped by this morning. If you have any additional questions for us, don’t hesitate to pop in and say hello!